Change the Rules of Engagement

The world’s leading Managed Detection & Response platform

What we do

Trusted by

Our Core Values

Vision

Velocity

Vigilance

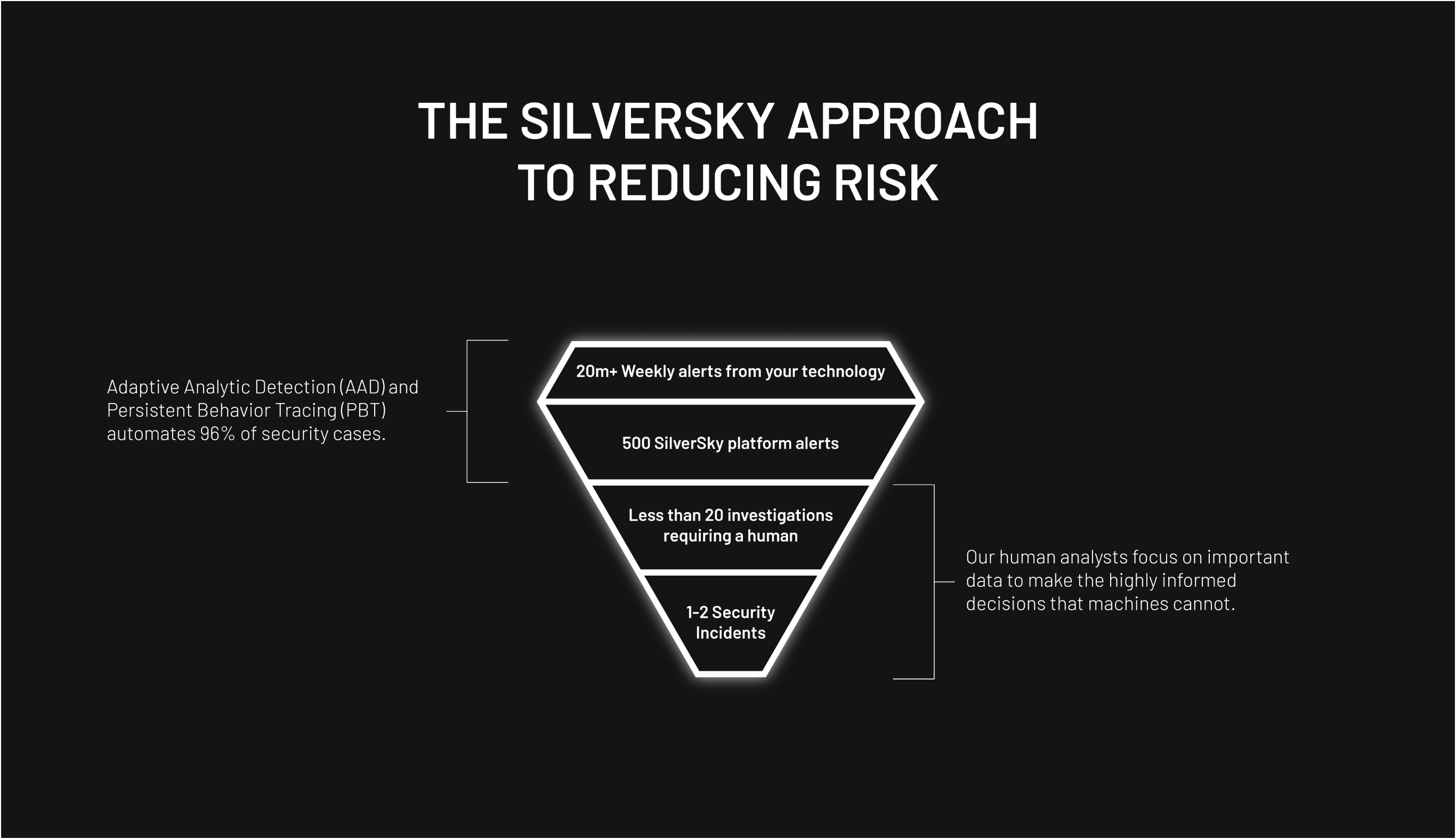

The Vigilance to combine military-grade behavioral tracking and machine learning, together with human analysis and support, to protect our customers’ attack surface as vigorously as their bottom lines.

Our authority to operate in some of the most sensitive government networks puts compliance at the core of our company.

Change the Rules of Engagement

With over twenty years of experience in cybersecurity, we’ve learned the best way to stay ahead of the game, is to change it.

Schedule a demo to see how we can change your business for the better.

EXTENDED DETECTION

AND RESPONSE (XDR)

Managed Detection &

Response (MDR)

Managed Endpoint Detection & Response

EMAIL PROTECT

NETWORK PROTECT

INSIGHT

CYBER ADVISOR SERVICE

Aware

CONNECT

SECURITY CONSULTING SERVICES

CONSOLIDATE YOUR SECURITY TECHNOLOGIES INTO A SINGLE VIEW

Our partners

Change, before you have to

Insight

Managed Detection and Response

Network protect

Managed Endpoint Detection and Response

cyber advisor service

Email Protect

Extended Detection and Response

Technology Scales, People Don’t

Our authority to operate in some of the most sensitive government networks puts compliance at the core of our company.

With over twenty years of experience in cybersecurity, we’ve learned the best way to stay ahead of the game, is to change it.

Schedule a demo to see how we can change your business for the better.

Explore SilverSky’s MDR Platform

Book a demo and see how SilverSky changes the rules of engagement.